At Square One Planning, we simplify your mortgage journey by providing a comprehensive mortgage calculator. This tool estimates your monthly mortgage payment, including your loan’s principal, interest, taxes, homeowners insurance, and private mortgage insurance (PMI). You can easily adjust the home price, down payment, and mortgage terms to see how these changes impact your monthly payment.

If you’re unsure how much you should budget for a new home, try our home affordability calculator for guidance.

A financial advisor can be instrumental in planning your home purchase. To find a financial advisor in your area, use Square One Planning’s free online matching tool.

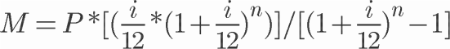

Mortgage Payment Formula

For those interested in the math behind mortgage calculations, here’s the formula we use to estimate your monthly payment:

M=Monthly Payment

P=Principal Amount (initial loan balance)

i=Interest Rate

n=Number of Monthly Payments for 30-Year Mortgage (30 12 = 360, etc.)

How Square One Planning’s Mortgage Payment Calculator Works

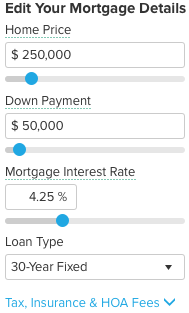

To determine your monthly payment, provide background information about your prospective home and mortgage. Fill in the home price, down payment, and mortgage interest rate fields. Choose your loan term from the dropdown box. Don’t worry about having exact numbers—use your best estimates. You can always adjust the figures later.

For a more detailed calculation, click the dropdown for “Taxes, Insurance & HOA Fees.” Here, you can input the home location, annual property taxes, annual homeowners insurance, and monthly HOA or condo fees, if applicable.

Factors Determining Your Mortgage Payment

Our mortgage payment calculator considers four key factors: home price, down payment, mortgage interest rate, and loan type. Here’s a breakdown of each factor and its influence on your payment.

Home Price

The home price is influenced by your income, monthly debt payments, credit score, and down payment savings. A common guideline is the 28/36 rule, which suggests your mortgage payment shouldn’t exceed 28% of your monthly pre-tax income and 36% of your total debt. This ratio helps lenders assess your financial capacity to pay your mortgage each month.

DTI=Total Monthly Debt PaymentsGross Monthly Income×100\text{DTI} = \frac{\text{Total Monthly Debt Payments}}{\text{Gross Monthly Income}} \times 100DTI=Gross Monthly IncomeTotal Monthly Debt Payments×100

To calculate your DTI, add all your monthly debt payments (credit card debt, student loans, alimony, child support, auto loans, and projected mortgage payments). Divide by your monthly pre-tax income and multiply by 100 to get a percentage.

Down Payment

Most mortgage lenders expect a 20% down payment for a conventional loan without PMI, although there are exceptions. For example, VA loans don’t require down payments, and FHA loans often allow down payments as low as 3%, though they include a type of mortgage insurance.

Below is a table showing how different down payment sizes impact your monthly mortgage payment:

| Percentage | Down Payment | Home Price | Principal & Interest |

|---|---|---|---|

| 20% | $40,000 | $200,000 | $804 |

| 15% | $30,000 | $200,000 | $854 |

| 10% | $20,000 | $200,000 | $905 |

| 5% | $12,500 | $200,000 | $955 |

| 0% | $0 | $200,000 | $1,005 |

(These calculations do not include property taxes, homeowners insurance, and PMI.)

Mortgage Rate

For the mortgage rate box, you can use our mortgage rates comparison tool to see what you might qualify for. Alternatively, use the rate provided by a potential lender during the pre-approval process. Your actual mortgage rate depends on factors such as your credit score and debt-to-income ratio.

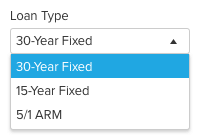

Loan Type

In the dropdown menu, select from a 30-year fixed-rate mortgage, 15-year fixed-rate mortgage, or 5/1 ARM. Fixed-rate loans have a consistent interest rate and monthly payments. An ARM, or adjustable-rate mortgage, has a rate that changes after an initial fixed period, typically adjusting annually. ARMs may offer lower initial rates, which can be advantageous if you plan to move or flip the house soon.

Costs Included in Your Monthly Mortgage Payment

Your monthly mortgage payment comprises several costs:

Monthly mortgage payment=Principal+Interest+Escrow Account Payment\text{Monthly mortgage payment} = \text{Principal} + \text{Interest} + \text{Escrow Account Payment}Monthly mortgage payment=Principal+Interest+Escrow Account Payment Escrow account=Homeowners Insurance+Property Taxes+PMI (if applicable)\text{Escrow account} = \text{Homeowners Insurance} + \text{Property Taxes} + \text{PMI (if applicable)}Escrow account=Homeowners Insurance+Property Taxes+PMI (if applicable)

Most homebuyers have an escrow account, which the lender uses to pay property taxes and homeowners insurance. Your monthly bill includes the principal and interest payment, homeowners insurance, property taxes, and, if necessary, PMI and HOA fees.

Principal and Interest

The principal is the borrowed loan amount, and the interest is the additional money owed to the lender, accruing over time. Fixed-rate mortgages have a consistent total principal and interest amount each month, but the proportion of each changes over time (known as amortization). Initially, you pay more interest than principal, but gradually, you pay more principal and less interest.

Homeowners Insurance

Homeowners insurance covers theft, fire, or storm damage. It can range from a few hundred to thousands of dollars annually, depending on your home’s size and location. Lenders require homeowners insurance to protect their collateral (your home).

Property Taxes

Property taxes, levied by counties and districts, vary widely. They are usually calculated as a percentage of your home’s value and billed annually. These taxes fund services like road maintenance, school budgets, and county services.

PMI

PMI is required if you don’t have a 20% down payment and don’t qualify for a VA loan. It’s calculated as a percentage of your original loan amount and ranges from 0.3% to 1.5%. Once you have at least 20% equity, you can request to stop paying PMI.

HOA Fees

HOA fees, common for condominiums or planned communities, cover the upkeep of shared amenities and building maintenance. These fees are disclosed upfront and are separate from property taxes and homeowners insurance.

How to Lower Your Monthly Mortgage Payment

Four common ways to lower your monthly mortgage payments include:

- Choose a longer loan term: Extending the loan term reduces monthly payments.

- Buy a less expensive house: A lower home price results in lower payments.

- Pay a larger down payment: Reduces the loan amount and avoids PMI.

- Find the lowest interest rate: Shop around with different lenders for the best rate.

At Square One Planning, we’re committed to helping you make informed decisions to manage your mortgage effectively. Explore our tools and resources to optimize your home buying experience.