Retirement Guide: Planning for Your Golden Years

The golden years of retirement can be both exciting and daunting to imagine. While it’s easy to fantasize about international adventures or relaxing by the beach, the financial groundwork needed to achieve these dreams is often overlooked. Immediate concerns like job responsibilities, raising children, mortgage payments, and car loans can make it challenging to prioritize retirement savings, especially when retirement seems far off.

Do you need help planning for your retirement? Find a financial advisor who serves your area with Square One Planning’s free online matching tool.

The Importance of Retirement Savings

Surveys consistently show that many Americans have insufficient retirement savings. A significant number of people in their 30s, 40s, and even 50s have little to no retirement savings. This “save-nothing” approach can lead to financial anxiety during retirement, overshadowing what should be a time of relaxation and enjoyment.

A sound retirement strategy doesn’t have to be complex. It starts with a simple question: How much do I need to save to retire comfortably? By consistently saving a portion of your income every month, you can alleviate financial stress in your senior years. A retirement calculator can help you determine the amount you need to save to achieve your retirement goals.

How Much Do I Need to Retire?

To figure out what it will take to retire comfortably, consider the lifestyle you want to lead in retirement. Do you plan to travel frequently? How often do you want to dine out or visit the movies? These questions can help you estimate your future income needs. For example, a lifestyle that includes extensive travel will require a larger nest egg compared to a more low-key retirement.

A common guideline is to replace 70% of your pre-retirement income through a combination of Social Security, investments, and retirement savings accounts like 401(k)s and IRAs. It’s also crucial to account for inflation, which will increase the cost of living over time.

Saving for Retirement: Assessing Your Current Situation

Whether you plan to live lavishly or frugally, you’ll need to save a certain amount by the time you retire. Think of this savings goal as a mountain summit. If you’ve been saving consistently, you might be on the right path. However, if your savings are lacking, you’ll need to adjust your strategy to reach your goal.

To determine your current financial situation, answer these questions:

- How much have I saved thus far?

- How many years until I retire?

- What’s my annual income, and how much of that do I want to replace?

The answers will guide you in calculating how much you need to save moving forward. Let’s look at some examples using a retirement calculator.

Starting Early

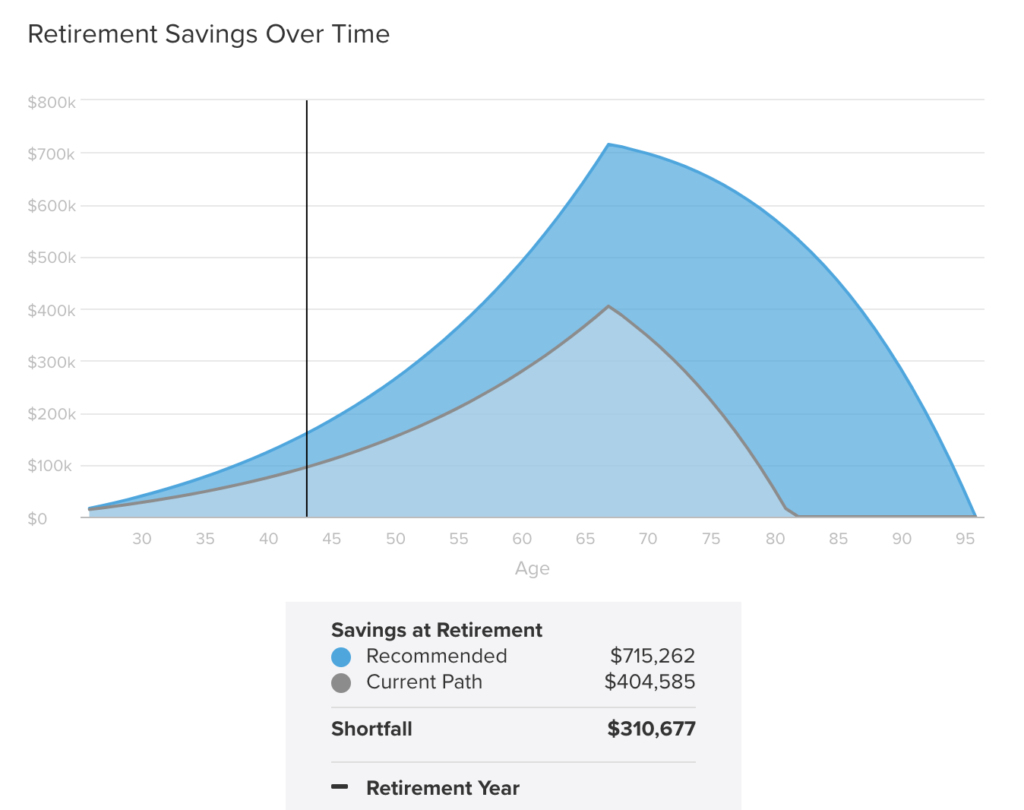

Imagine you’re 25, earning $50,000 per year in Tulsa, Oklahoma. You have $5,000 in savings and contribute $100 per month to your 401(k), with an employer match of up to 5% of your income. To replace 70% of your income in retirement, you need to save about $189 per month. If you continue saving only $100 per month, you’ll fall short of your retirement goal by $310,677.

Mid-Career Savings

Now, consider a 40-year-old in Pittsburgh earning $80,000 annually, with $20,000 in savings and $22,000 in a traditional IRA. Planning to live on 65% of their salary in retirement, they need to save $533 per month. This plan puts them on track for a comfortable retirement with a small surplus.

Catching Up Later in Life

A 54-year-old talent agent in Los Angeles earning $100,000 has $50,000 in savings. Planning to retire at 70 and live on 70% of their salary, they need to save $1,950 per month. Without increasing their savings rate, they will fall short by $488,143.

The Best Laid Plans

Regardless of your current situation, the key is to start saving now and adjust your plan as needed. Economic downturns and other unexpected events can impact your savings, but a solid plan can help you navigate these challenges.

Using a Retirement Calculator

A retirement calculator helps you estimate how much you need to save to reach your retirement goals. By entering details about your current savings, income, and retirement plans, you can see how much you need to save each month to achieve your desired lifestyle.

Conclusion

Planning for retirement requires a thoughtful approach to saving and investing. By setting realistic goals and consistently saving, you can build a nest egg that allows you to enjoy your golden years without financial stress. Use tools like a retirement calculator to stay on track and consult a financial advisor to optimize your retirement plan.

Financial Planning Tips for New Home Buyers

Introducing a mortgage into your life often requires adjustments to your long-term financial plan. A financial advisor can assist you in navigating these changes. Square One Planning’s free tool matches you with up to three vetted financial advisors in your area, allowing you to interview your matches at no cost. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.